child tax credit 2022 qualifications

Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. To qualify for the EITC a qualifying child must.

Parents Guide To The Child Tax Credit Nextadvisor With Time

Parents and or grandparents that stayed with a child for more than six months and were the primary caregivers are eligible for the tax credit.

. For ever 1000 pass the threshold theres a 10 reduction of the payment. These payments were part of the American Rescue Plan a 19 trillion dollar. Families who do not qualify under these new income limits are.

Biden may propose extending the expanded child tax credit that came with monthly payments of up to 300 per child to eligible families last year. Already claiming Child Tax Credit. A 2000 credit per dependent under age 17.

In the meantime the expanded child tax credit and advance monthly payments system have expired. You should file an application with the Connecticut Department of Revenue Services to get the payment. For children under 6 the amount jumped to 3600.

Have a valid Social Security Number. There was a partial refundability in child Tax Credit till 2020. Stimulus Check Updates Stimulus Check Updates.

For 2022 that amount reverted to 2000 per child dependent 16 and younger. The income maximum is 75000 and under for everyone else. The Child Tax Credit was only partially refundable prior to 2021 with this being up to 1400 per qualifying child and you needed at least.

The maximum credit for taxpayers with no. However if a family earns more than that the benefit begins to diminish. Married couples filing a joint return with income of 400000 or less.

The income limit for the 2017 tax. Meet all 4 tests for a qualifying child. This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17.

The maximum credit amount is 1000 per child. The recipient was only getting an amount of 1400 per child. Not be claimed by more than one person as a qualifying child.

People who are eligible for a partial amount of Child Tax Credit. Further to get the benefit the taxable person should have at least 2500 as earned income. You may claim the Earned Income Tax Credit EITC for a child if you meet the rules for a qualifying child.

They earn 112500 or less for a family with a single parent commonly known as Head of Household. A 70 percent. Previously low-income families did not get the same amount or any of the Child Tax Credit.

Income qualifications vary based on marital status. The amount you can get depends on how many children youve got and whether youre. Claiming the child tax credit.

You must have claimed at least one child on your 2021 tax return who was 18 or younger. In 2022 the credit dropped to its previous level of 2000 per qualifying child younger than age 17. The maximum child tax credit amount will decrease in 2022.

Those checks stopped in January because the. It also now makes 17-year-olds eligible for the 3000 credit. The first one applies to the extra credit amount added to.

In 2020 eligible taxpayers could claim a tax credit of 2000 per qualifying dependent child under age 17. They earn 150000 or less per year for a married couple. Income thresholds of 400000 for married couples and 200000 for all other filers single taxpayers and heads of households.

Making a new claim for Child Tax Credit. Tax Changes and Key Amounts for the 2022 Tax Year. The child tax credit is not available to taxpayers who earn too much money.

The child tax credit is a tax credit available to parents for each qualifying child under the age of 17. Changes to the Child Tax Credit for 2022 include lower income limits than the original credit. The expanded child tax credit by comparison provides 3600 for.

Parents with higher incomes also have two phase-out schemes to worry about for 2021. To qualify a child must be claimed as a dependent on the parents tax return. Married couples earning under 150000 qualify as do single parents with income under 112500.

The Child Tax Credit is not claimable at every income level. Additionally the child needs to have lived with you for at least six months of the previous year. Families with a single parent also called Head of Household with income of 200000 or less.

For each child ages 6 to 16 its increased from 2000 to 3000. To qualify for the child tax credit you need to have supported the child for at least half of the previous tax year. The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21430 for those filing single and 27380 for spouses filing a joint return.

Under the American Rescue Plan all families in need will get the full amount. Nearly every child under the age of 18 before january 1 2022 qualifies for the child tax credit an estimated 65 million people and about 61 million received the monthly payments. These people qualify for a 2021 Child Tax Credit of at least 2000 per qualifying child.

Latest on Child Tax Credit Payments Cola 2022 IRS Tax Refunds. According to the IRS website working families will be eligible for the whole child tax credit if. Finally you need to meet income requirements.

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. If the amount of the credit exceeded the tax that was owed the taxpayer was generally eligible to receive a refund for the excess credit amount up to 1400 per qualifying child.

What Families Need To Know About The Ctc In 2022 Clasp

Child Tax Credit For 2022 Here S How Some Families May Get 7 200 Next Year

Input Tax Credit Itc In Gst Meaning How To Claim It And Examples In 2022 Tax Credits Tax Indirect Tax

As An Accomplished Chief Executive Officer I Would Bring My Innovative And Successful Business Appr Cover Letter For Resume Cover Letter Example Letter Example

Child Tax Credit 2022 How To Receive Your Payments Next Year Marca

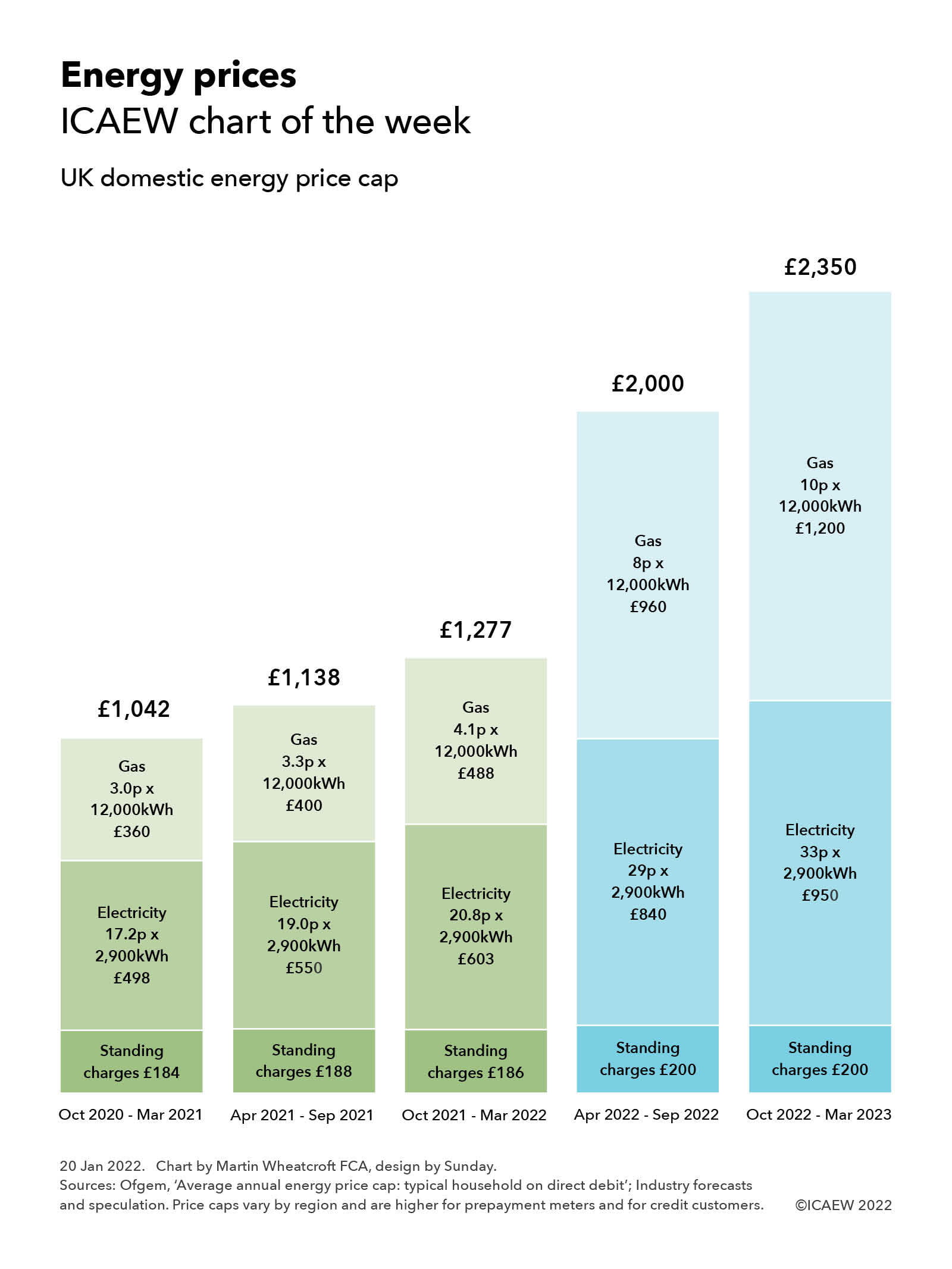

Chart Of The Week Energy Prices Icaew

England Council Tax Rebate 2022 Turn2us

Child Tax Credit 5 Things You Need To Know In 2022 Gobankingrates

Child Tax Credit 2022 How To Claim The New Payments On Getctc Marca

Child Tax Credit Can You Claim A 17 Year Old Child On Your Taxes Marca

Child Tax Credit Do You Have To Pay It Back In 2022 Not If You Re In These Cases Marca

Tax Season 2022 What To Know About Child Credit And Stimulus Payments The Seattle Times

Taxes 2022 Important Changes To Know For This Year S Tax Season

Child Tax Credit 2022 Update Americans Still Have A Chance To Claim 3 600 Per Child Find Out How You Can Get It

Here Are New Tax Law Changes For The 2022 Tax Season Forbes Advisor

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Irs Recovery Rebate Tax Credit 2022 How To Claim It Next Year Marca